Millage rate calculator

The number you calculate millage multiplied by taxable value tells you the property taxes owed before any credits. In a county where the millage rate is 25 mills the property tax on that house would be 1000.

Millage Rates And Real Estate Property Taxes For Macomb County Michigan

The millage rates would apply to that reduced number rather than the.

. Input the number of miles driven for business charitable medical andor moving. For the final 6. Routes are automatically saved.

Mileage calculator Enter your route details and price per mile and total up your distance and expenses. You can calculate mileage reimbursement in three simple steps. We used the above findings from our analysis as the basis for our rate calculator.

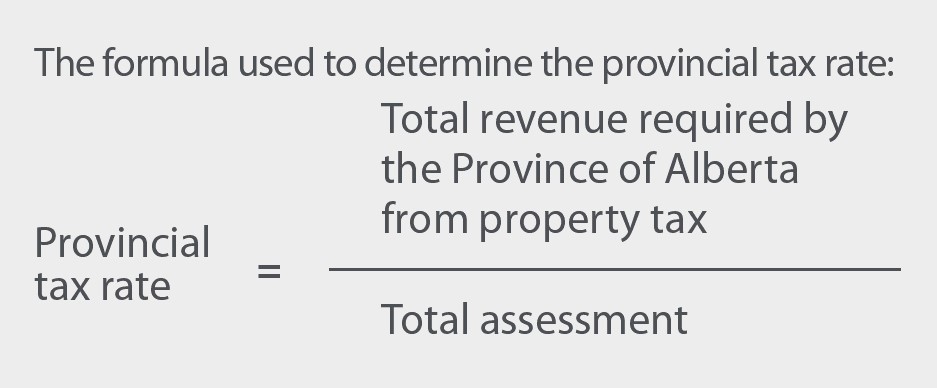

Tax Rates are Set. Property taxes in Florida are implemented in millage rates. A number of different.

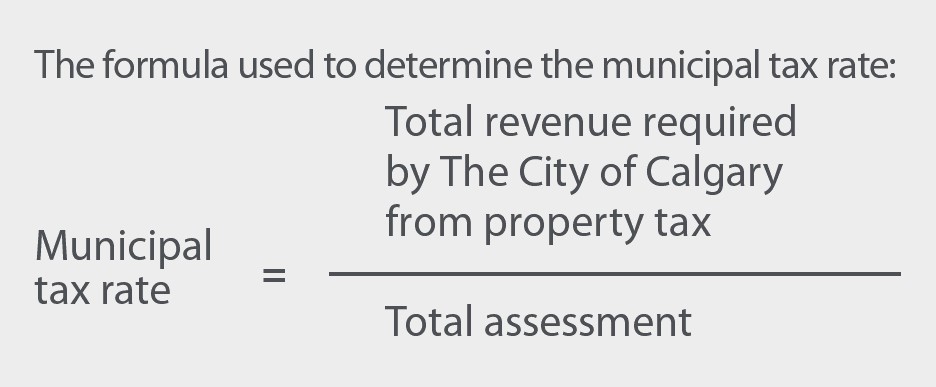

The Georgia County Ad. A millage rate is one tenth of a percent which equates to 1 in taxes for every 1000 in home value. A millage rate is the tax rate used to calculate local property taxes.

The first number after the decimal point is tenths 1 the second number after the decimal point is hundredths 01 and going out three places is thousandths 001 or mills. Mileage Rate or Kilometer Rate Enter a price per mile or price per kilometer to calculate the total charge incurred on this trip. CompanyMileages Mileage Rate Calculator.

Select your tax year. The Millage Rate database and Property Tax Estimator allows individual and business taxpayers to estimate their current property taxes as well as compare their property taxes. You can improve your MPG with our eco-driving.

Municipality Millage Code 2021 Millage Rate 2020 Millage Rate 2019 Millage Rate 2018 Millage Rate 2017 Millage Rate. First determine the total number of mills in your local tax district. 2020 Millage Rates - A Complete List.

If the assessor determines that the. The Board of County Commissioners School Board City Commissioners and other tax levying bodies set the millage rate which is the rate of tax per one thousand dollars. Assessed Value Mill Rate 1000 - The assessed value is 70 percent of the appraised fair market value determined by the assessor.

25 for every 1000 of assessed value or 25 multiplied by 40 is 1000. By using the initial rate the IRS set for 2022 as a. Taxpayers may use the optional standard mileage rates to calculate the deductible costs of operating an automobile for business and certain other purposes.

Mileage Calculator Use the following mileage calculator to determine the travel distance in terms of miles and time taken by car to travel between two locations in the United. 2018 Millage Rates - A Complete List. 2019 Millage Rates - A Complete List.

It represents the number of dollars taxed per every 1000 of a propertys assessed value. A mileage allowance for using a privately owned vehicle POV for local TDY and PCS travel is reimbursed as a rate per mile in lieu of reimbursement of actual. 25 rows Mileage Rates.

Property owners can use mills to calculate their property tax rate and total property tax amount. This may be helpful for expense tax deductions or lease. 2021 Millage Rates - A Complete List.

Property Tax Tax Rate And Bill Calculation

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

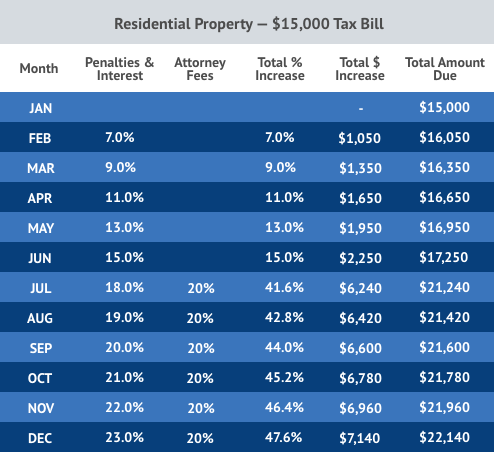

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease

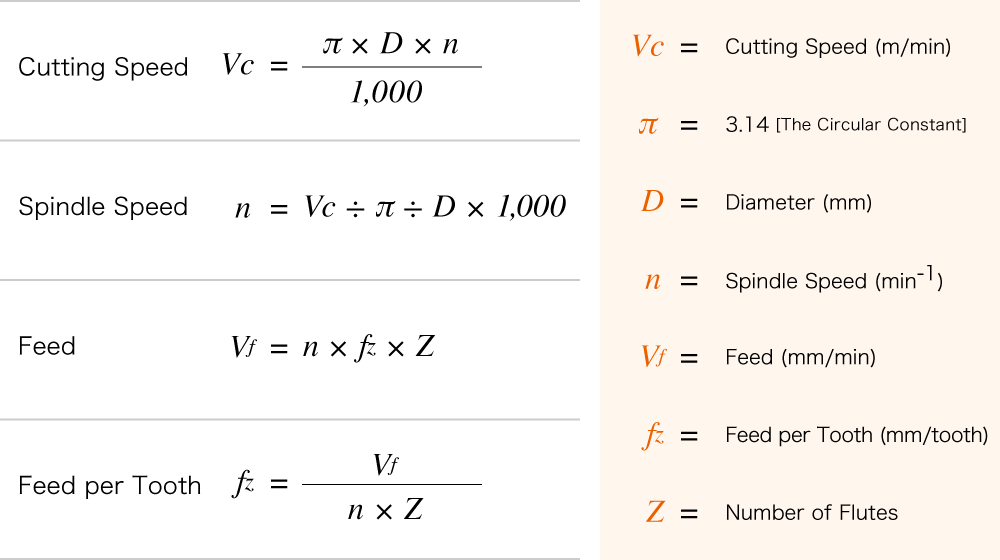

Calculation For Cutting Speed Spindle Speed And Feed Ns Tool Co Ltd

Property Tax Millage Rate 13 Things 2022 You Need To Know

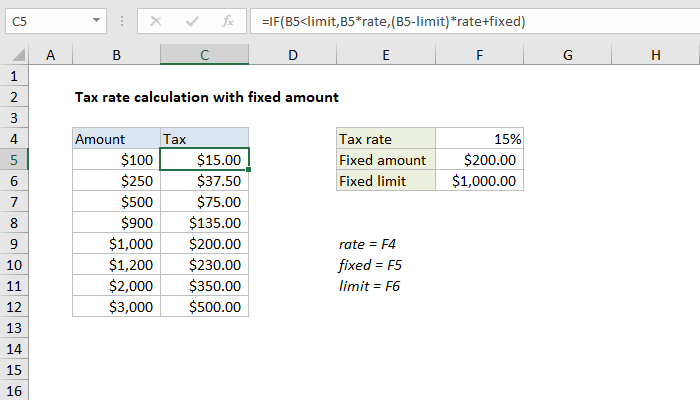

Excel Formula Tax Rate Calculation With Fixed Base Exceljet

Hennepin County Mn Property Tax Calculator Smartasset

Montgomery County Tn

Property Tax How To Calculate Local Considerations

Property Tax Millage Rate 13 Things 2022 You Need To Know

New York Property Tax Calculator Smartasset

New York Property Tax Calculator 2020 Empire Center For Public Policy

Property Tax Tax Rate And Bill Calculation

Property Tax Calculator

Washington County School District Tax Rates Millage

Excel Formula Basic Tax Rate Calculation With Vlookup Exceljet

The Property Tax Equation